We Discuss the Most Overpriced Stocks to Avoid (and Provide Cheaper Alternatives to Each Company)

In the stock market, two things are really important: knowing how to find companies trading at a discount and knowing how to avoid companies trading at a high premium. There’s nothing worse than buying the top of a price run and then wondering if you were the “greater fool” who bought into a dying trend. In this article, we discuss a few overpriced stocks trading right now. We also provide cheaper similar alternatives based on each company’s industry sector.

All overpriced and alternative companies were identified using the Simple Investing Success stock screener, which scans for companies meeting our simple criteria of cheap and good, using simple metrics for discount and valuation.

Three Overpriced Stocks to Avoid

Cheaper Alternatives to Each Overpriced Stock

- Alternative to Groupon (GPRN): 1-800-FLOWERS.com (FLWS)

- Alternative to The Children’s Place (PLCE): Carter’s (CRI)

- Alternative to CarParts.com (PRTS): Motorcar Parts of America (MPAA)

Let’s take a closer look at each company to see why it should be avoided.

Overpriced Stock:

Groupon (GRPN)

Groupon

Groupon is currently trading at an earnings yield of 1.06%, 1.25% lower than the yield for the Online Retail sector of 2.31% and 1.81% lower than S&P 500 yield of 2.87%. The company’s current return on invested capital is 2.25%.

The YTD performance for Groupon is -41.99%.

Earnings Yield: 1.06%

Price/Earnings: 77.84

EBITDA: $108.83M

ROIC: 2.25%

Return on Assets: 0.72%

Price/Free Cash Flow: NA

Cheaper Alternative:

1-800-FLOWERS (FLWS)

1-800-FLOWERS.com

1-800-FLOWERS is a cheaper alternative to Groupon in the Online Retail industry sector. 1-800-FLOWERS is currently trading at a P/E of 17.57 and a return on invested capital of 18.26%. 1-800-FLOWERS also has an earnings yield of 8.74%, higher than the yield of the Online Retail sector of 2.31%.

The YTD performance for 1-800-FLOWERS is 24.46%.

Earnings Yield: 8.74%

Price/Earnings: 17.57

EBITDA: $197M

ROIC: 18.26%

Return on Assets: 12.38%

Price/Free Cash Flow: 8.36

Overpriced Stock:

The Children’s Place (PLCE)

The Children’s Place

The Children’s Place is currently trading at an earnings yield of 1.45%, 5.35% lower than the yield for the Retail industry sector of 6.80% and 1.42% lower than S&P 500 yield of 2.87%. The company’s current return on invested capital is 2.46%.

The YTD performance for The Children’s Place is 65.99%.

Earnings Yield: 1.45%

Price/Earnings: 13.82

EBITDA: $327.73M

ROIC: 2.46%

Return on Assets: 7.87%

Price/Free Cash Flow: 87.72

Cheaper Alternative:

Carter’s (CRI)

Carter’s

Carter’s is a cheaper alternative to The Children’s Place in the Retail industry sector. Carter’s is currently trading at a P/E of 12.73 and a return on invested capital of 12.96%. Carter’s also has an earnings yield of 8.26%, higher than the yield of the Retail sector of 6.80%.

The YTD performance for Carter’s is 2.53%.

Earnings Yield: 8.26%

Price/Earnings: 12.73

EBITDA: $563.65M

ROIC: 12.96%

Return on Assets: 9.94%

Price/Free Cash Flow: 12.06

Overpriced Stock:

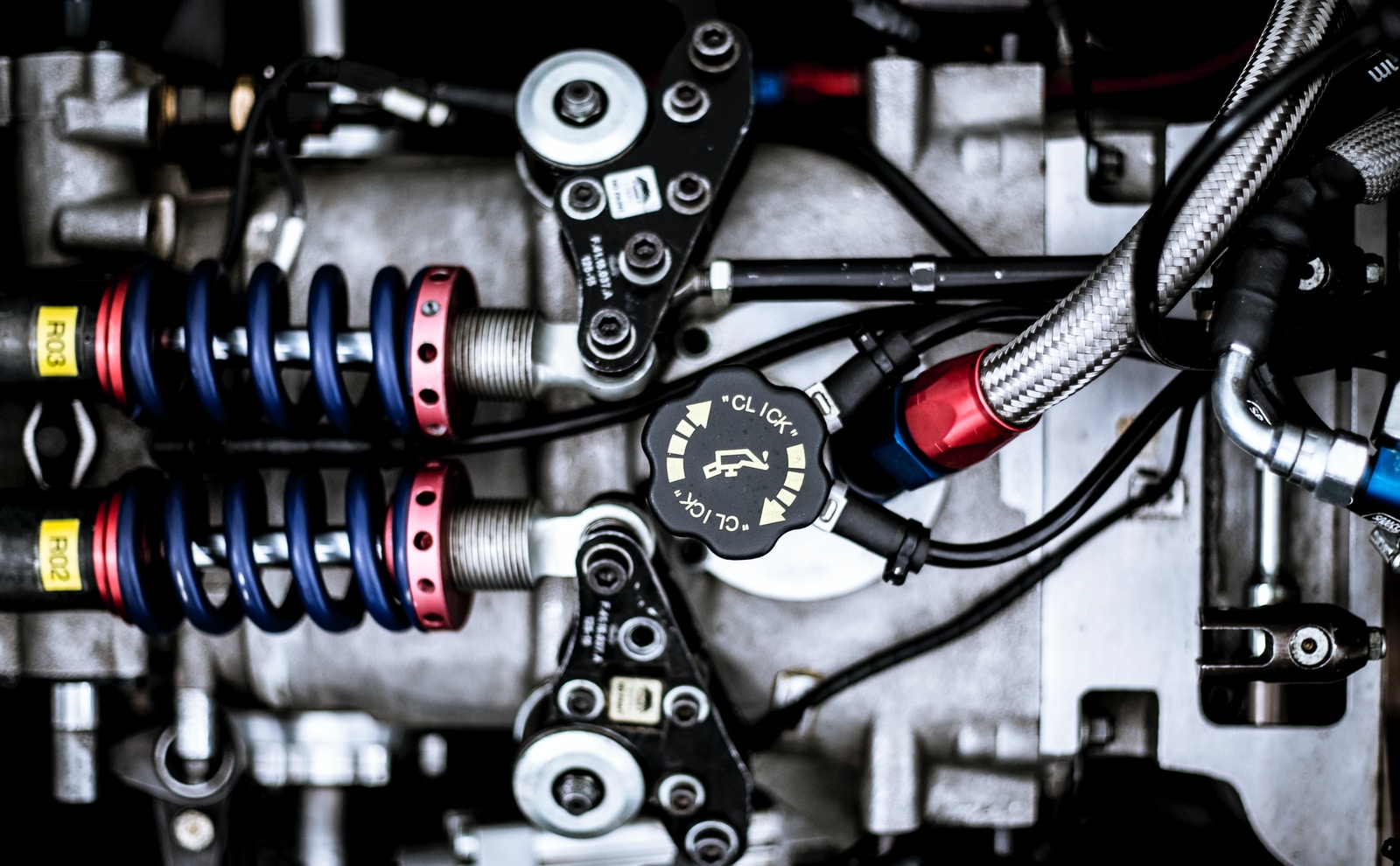

CarParts.com (PRTS)

CarParts.com

CarParts.com is currently trading at an earnings yield of 1.60%, 0.71% lower than the yield for the Online Retail sector of 2.31% and 1.27% lower than S&P 500 yield of 2.87%. The company’s current return on invested capital is -3.40%.

The YTD performance for CartParts.com is 32.45%.

Earnings Yield: 1.60%

Price/Earnings: Unreported

EBITDA: $7.09M

ROIC: -3.40%

Return on Assets: -1.58%

Price/Free Cash Flow: NA

Cheaper Alternative:

Motorcar Parts of America (MPAA)

Motorcar Parts of America

MotorCar Parts is a cheaper alternative to CarParts.com in the online retail industry sector. MotorCar Parts is currently trading at a P/E of 14.43 and a return on invested capital of 6.48%. MotorCar Parts also has an earnings yield of 9.84%, higher than the yield of the online retail sector of 2.31%.

The YTD performance for MotorCar Parts is -4.43%.

Earnings Yield: 9.84%

Price/Earnings: 14.43

EBITDA: $61.04M

ROIC: 6.48%

Return on Assets: 3.05%

Price/Free Cash Flow: 22.29

Be sure to add these picks to your Watch List and if you haven’t done so already, check in on the performance of our Current Portfolio. Keep it simple and always do your due diligence.