National HealthCare Corp. (NHC) Company Overview & Stock Price Forecast

This article provides a brief analysis and stock rating for National HealthCare Corporation (NHC) including an updated stock price target. Additional data on the company’s earnings yield, price/earnings ratio, return on invested capital and YTD performance are discussed as well.

National HealthCare Fundamentals

Stock Price Target: $78.11

In the section below, we discuss the earnings yield, P/E, return on invested capital and YTD performance for National HealthCare Corporation in comparison to the HealthCare Facilities industry and the S&P 500.

National HealthCare is a Small Cap company with a Market Cap of $955.6M.

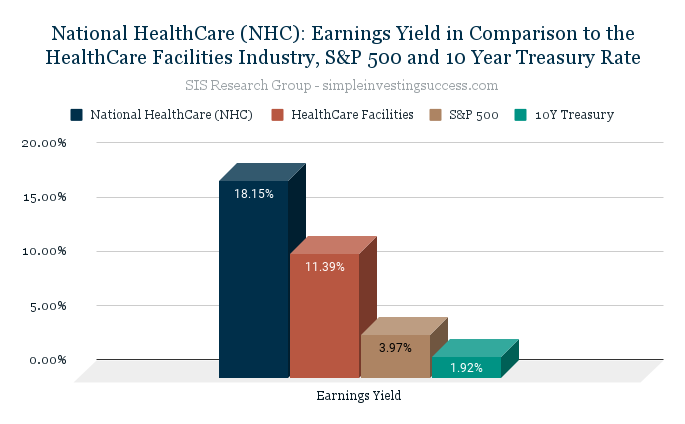

How are investors using National HealthCare earnings yield to assess the company?

The earnings yield is used to show the percentage of a company’s earnings per share. Investors typically use earnings yield to determine which assets are underpriced or overpriced relative to other variables, like sector, industry or bond yields. Simply put, the earnings yield of a company can be used to assess how expensive a company is in relation to the earnings that are generated. When valuing companies, the SIS Research Group does not utilize the inverse P/E ratio to calculate the earnings yield. Instead, we use an adjusted earning yield calculation to capture variation amongst companies (i.e. debt and tax rates).

The current earnings yield for National HealthCare is 18.15%, in comparison to 3.97% for the S&P 500 and 1.92% for the 10-year treasury bond. The median earnings yield for the HealthCare Facilities industry is 11.39%.

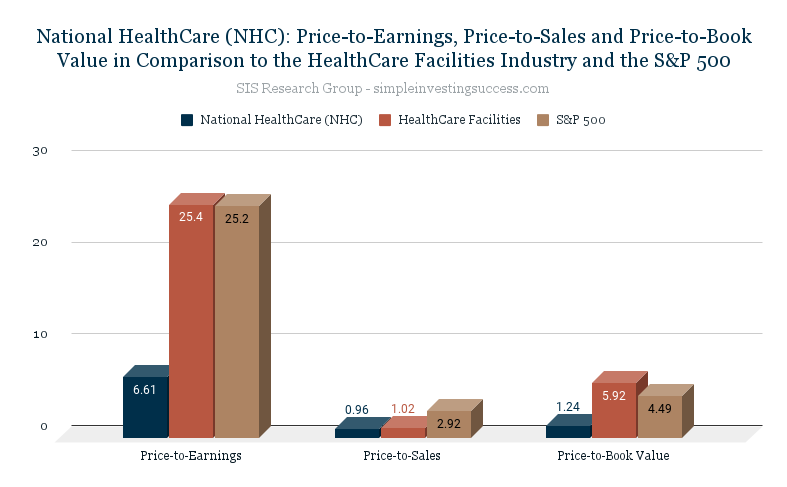

What does National HealthCare Price-to-Earnings Ratio (P/E) tell investors about the company?

The price-to-earnings ratio (P/E) is a relatively popular metric used by investors and analysts for valuing a company’s stock. The P/E ratio can be used to show how a stock’s valuation compares to other companies and the total market. Investors use the P/E ratio to determine what the market is willing to pay today based on a company’s past or future earnings. A high P/E ratio could mean that a stock’s price is too high relative to earnings, which could be a signal that a stock is currently overvalued. In turn, a low P/E ratio could indicate that a company’s current stock price is low relative to earnings.

National HealthCare is currently trading at a P/E of 6.61. The P/E for the HealthCare Facilities industry is 25.4 and the P/E for the S&P 500 is 25.2.

What is the current Price-to-Sales Ratio (P/S) for National HealthCare?

The Price-to-Sales Ratio (P/S) looks at a company’s market cap and revenue to determine valuation. The P/S ratio is calculated by taking a company’s market cap and dividing by the total sales or revenue. The P/S ratio gives an idea of how much the market values every dollar of a company’s sales and can be effective in valuing unprofitable growth stocks or companies that are currently undergoing special situations or challenges. A lower the P/S ratio can be an indicator of good value.

National HealthCare is currently trading at a P/S of 0.96. The P/S for the HealthCare Facilities industry is 1.02 and the P/S for the S&P 500 is 2.92.

How does National HealthCare Price-to-BookRatio (P/B) compare to the HealthCare Facilities industry?

Price-to-book value (P/B) is the ratio of the market value of a company’s shares divided by its book value of equity (the value of it’s assets on the books). The book value is the difference between the book value of assets and liabilities. Typically, investors use the P/B ratio to assess if a stock is valued properly (a value of one means that the stock price is trading in line with the book value of the company). A company with a high P/B ratio could mean the stock price is overvalued as well as the converse.

National HealthCare P/B ratio is 1.24. The P/B for the HealthCare Facilities industry is 5.92 and the P/B for the S&P 500 is 4.49.

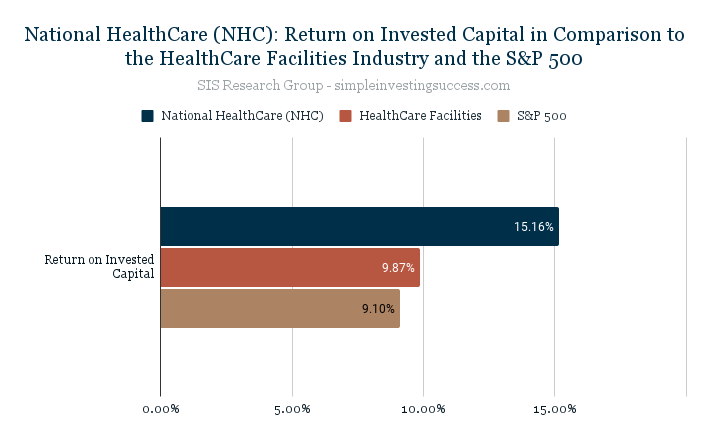

How attractive is National HealthCare Return on Invested Capital (ROIC) to investors?

Investors use the return on invested capital (ROIC) to assess how efficient a company is at turning capital into profits. The ROIC is the amount of money a company makes on it’s investments that is above the average cost of debt and equity.

Investors can use the ROIC to provide context for metrics like the (P/E) ratio. For instance, when used in isolation a low P/E ratio could suggest a company is oversold but the decline could be because a company is no longer generating value for shareholders. Conversely, companies that consistently generate high rates of ROIC can plausibly trade at a premium compared to other stocks, even if their P/E ratios are high.

National HealthCare ROIC is currently 15.16% in comparison to 9.87% for the HealthCare Facilities industry and 9.10% for the S&P 500.

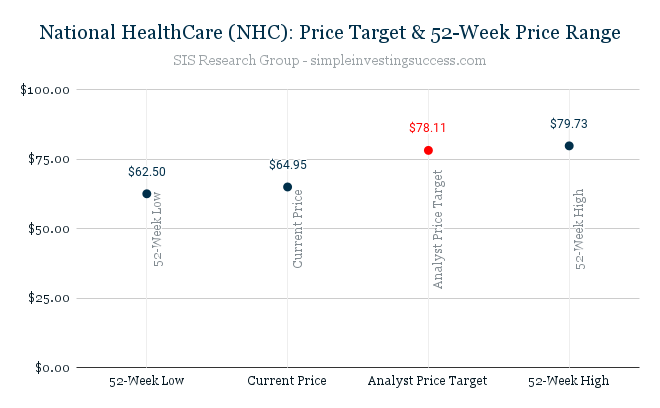

How has NHC stock performed over the past year? What is the current analyst price target?

Over the past 52 weeks, National HealthCare has traded between the range of $62.50 and $79.73.

The current Analyst Price Target for National HealthCare is $78.11.

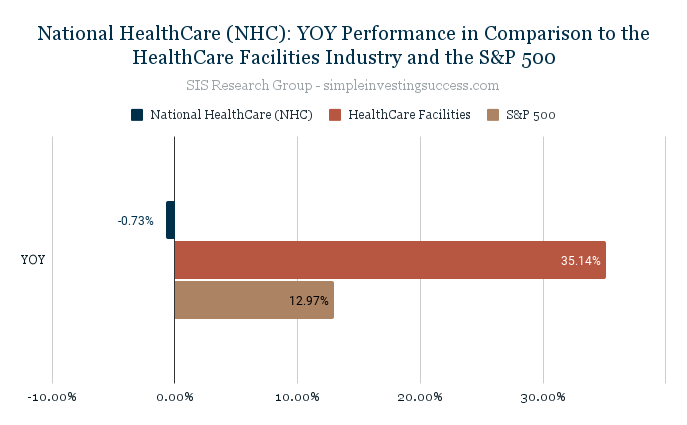

What is National HealthCare YOY Performance in comparison to its industry and the total market?

The YOY performance for National HealthCare is -0.73%. The HealthCare Facilities industry has a YOY performance of 35.14% in comparison to the YOY S&P 500 performance of 12.97%.

Recent Financial Results

- Net operating revenues and CARES Act income for the quarter totaled $276M compared to $250M for the same quarter in 2020, an increase of 10.4%

- Net operating revenues increase for the third quarter of 2021 was primarily driven by the June 2021 controlling equity interest acquisition of Caris Healthcare

- Net loss attributable to NHC was $3.3M compared to net income attributable to NHC of $12.8M for the same period in 2020

- Adjusted net income of $14.8M compared to $13.4M for the same period in 2020

Stock Price Target: $78.11

Company Overview

National HealthCare Corporation operates, manages, and provides services to skilled nursing facilities, assisted living facilities, independent living facilities, home health care programs, and a behavioral health hospital.

The company was founded in 1971 in Murfreesboro, TN. The current CEO is Stephen Fowler Flatt.

Be sure to add National HealthCare Corporation (NHC) to your Watch List and if you haven’t done so already, check in on the performance of our Current Portfolio. Keep it simple and always do your due diligence.

This material is provided for informational purposes only and is not financial advice. The information contained herein should not solely be used for the formation of an investment decision, whether you are a long term or short term investor.