We Discuss Companies That Investors Are Buying That Recently Posted 52-Week Lows

52-Week Lows Investors Are Buying

Let’s take a closer look at each company.

Treehouse Foods Inc. (THS)

Analyst Price Target: $50.87

How are investors assessing Treehouse Foods?

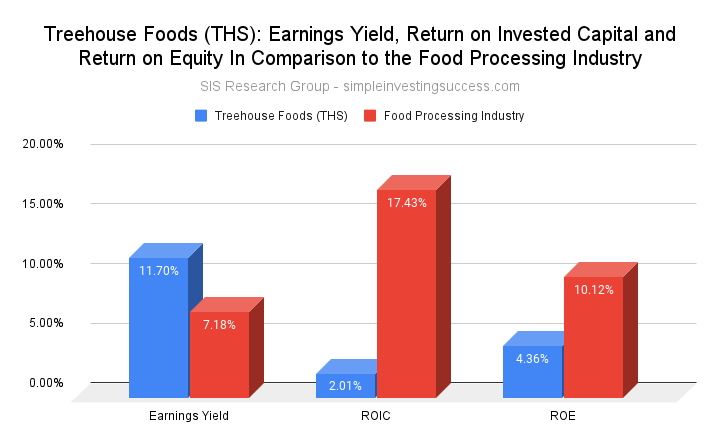

Treehouse Foods reported a return on invested capital (ROIC) of 2.01% in comparison to the Food Processing Industry ROIC of 17.43%. The current earnings yield for Treehouse Foods is 11.70%, 4.52% higher than the Food Processing Industry yield of 7.18%. Additionally, Treehouse Foods has a return on equity (ROE) of 4.36%, compared to the Food Processing Industry ROE of 10.12%.

How has THS stock performed over the past year? What is the current analyst price target?

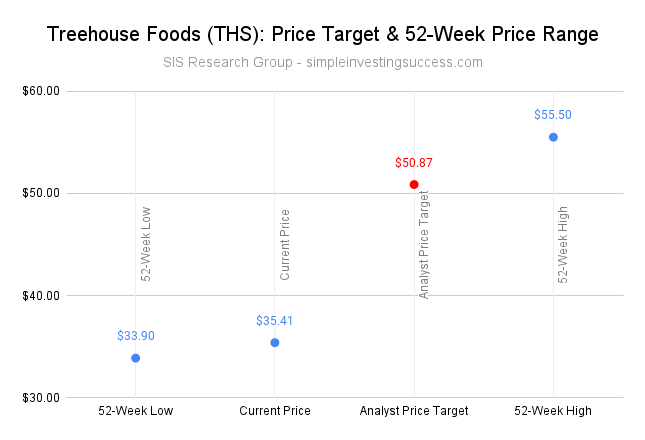

Over the past 52 weeks, Treehouse Foods has traded between the range of $33.90 and $55.50.

The current Analyst Price Target for Treehouse Foods is $50.87.

What type of business does Treehouse Foods engage in?

TreeHouse Foods manufactures and distributes private label packaged foods and beverages in the US and internationally. It operates in two segments: Meal Preparation and Snacking & Beverages. The company sells its products through various distribution channels, including grocery retailers and foodservice distributors, as well as industrial and export, which includes food manufacturers and repackagers of foodservice products. TreeHouse Foods was founded in 1862 and is based in Oak Brook, Illinois. The current CEO is Steven Oakland.

Treehouse Foods is a Small Cap company with a market cap of $1.94B. The YTD performance for THS is -18.52%.

Purple Innovation (PRPL)

Analyst Price Target: $35.17

How are investors assessing Purple Innovation?

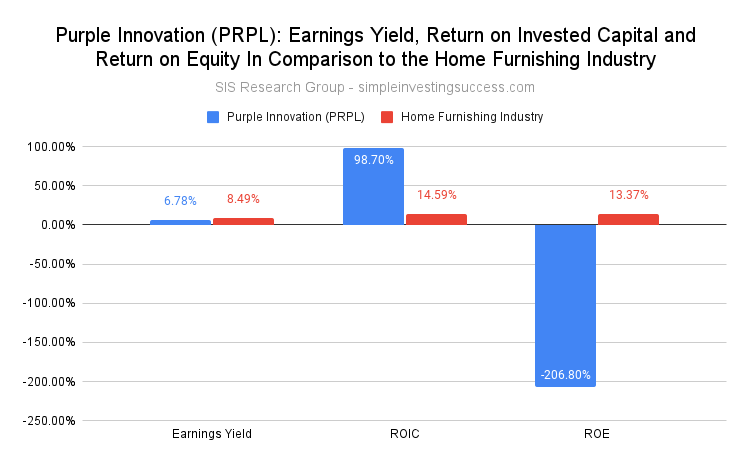

Purple Innovation reported a return on invested capital (ROIC) of 98.70% in comparison to the Home Furnishings Industry ROIC of 14.59%. The current earnings yield for Purple Innovation is 6.78%, 1.71% lower than the Home Furnishings Industry yield of 8.49%. Additionally, Purple Innovation has a return on equity (ROE) of -206.80%, compared to the Home Furnishings Industry ROE of 13.37%.

How has PRPL stock performed over the past year? What is the current analyst price target for PRPL stock?

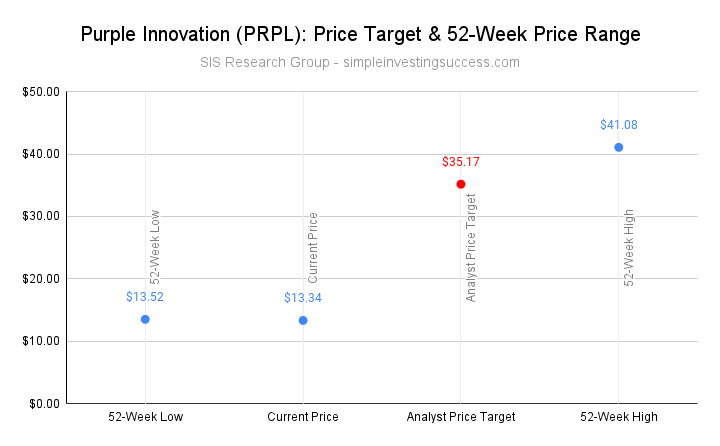

Over the past 52 weeks, Purple Innovation has traded between the range of $13.52 and $41.08.

The current Analyst Price Target for Purple Innovation is $35.17.

What type of business does Purple Innovation engage in?

Purple Innovation designs and manufactures mattresses, pillows, and cushions. It also offers sheets, bed frames and weighted blankets. The company markets and sells its products through direct-to-consumer online channels, retail brick-and-mortar wholesale partners, as well as through its factory outlet and the company owned showrooms. Purple Innovation was founded in 2010 and is headquartered in Lehi, Utah. The current CEO is Joseph Megibow.

Purple Innovation is a Small Cap company with a market cap of $902.8M. The YTD performance for PRPL is -59.50%.

Conagra Brands (CAG)

Analyst Price Target: $40.38

How are investors assessing Conagra Brands?

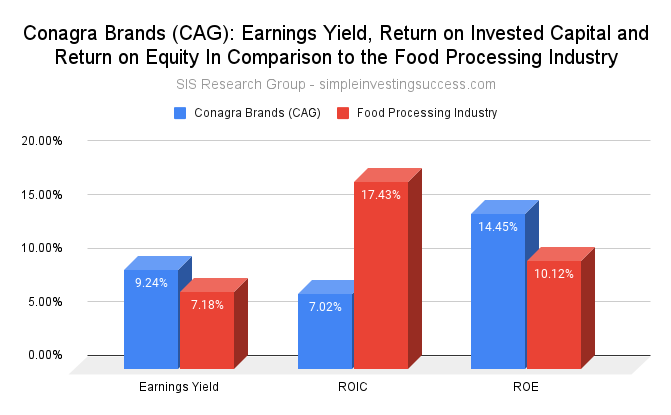

Conagra Brands reported a return on invested capital (ROIC) of 7.02% in comparison to the Food Processing Industry ROIC of 17.43%. The current earnings yield for Conagra Brands is 9.24%, 2.06% higher than the Food Processing Industry yield of 7.18%. Additionally, Conagra Brands has a return on equity (ROE) of 14.45%, compared to the Food Processing Industry ROE of 10.12%.

How has CAG stock performed over the past year? What is the current analyst price target?

Over the past 52 weeks, Purple Innovation has traded between the range of $32.07 and $39.09.

The current Analyst Price Target for Purple Innovation is $40.38.

What type of business does Conagra Brands engage in?

Conagra Brands, Inc., together with its subsidiaries, operates as a consumer packaged goods food company in North America. The company operates through Grocery & Snacks, Refrigerated & Frozen, International, and Foodservice segments. The company sells its products under a few of the following brands: Duncan Hines, Healthy Choice, and Angie’s BOOMCHICKAPOP. Conagra Brands was incorporated in 1919 and is headquartered in Chicago, Illinois. The current CEO is Sean Connolly.

Conagra Brands is a Small Cap company with a market cap of $1.21B. The YTD performance for CAG is -11.06%.

All companies were identified using SIS Research Group valuation methodology, which seeks out undervalued companies, using simple quantitative metrics. Many of the companies that SIS Research Group issues valuations for can be viewed in our public case study (access here) which tracks a portfolio of primarily micro and small cap companies on a quarterly basis. Additionally, companies meeting discount criteria can also be found in the SIS Research Group public database, which is updated quarterly (access here).

We hope you enjoyed this list of stocks investors are buying that recently posted 52-Week Lows. Be sure to add PRPL stock to your Watch List and if you haven’t done so already, check in on the performance of our Current Portfolio. Keep it simple and always do your due diligence.

This material is provided for informational purposes only and is not financial advice. The information contained herein should not solely be used for the formation of an investment decision, whether you are a long term or short term investor.