Stagwell (STGW) Company Overview & Stock Price Forecast

This article provides a brief analysis and stock rating for Stagwell (STGW) including an updated stock price target. Additional data on the company’s earnings yield, price/earnings ratio, return on invested capital and YTD performance are discussed as well.

Stagwell Fundamentals

Stock Price Target: $19.21

In the section below, we discuss the earnings yield, P/E, return on invested capital and YTD performance for Stagwell in comparison to the Advertising industry and the S&P 500.

Stagwell is a Small Cap company with a Market Cap of $2.03B.

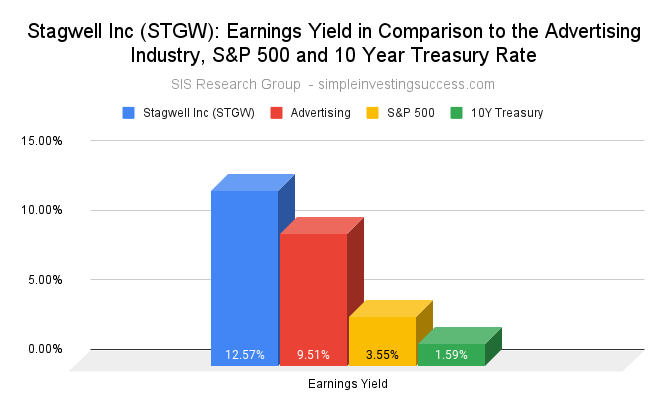

How are investors using Stagwell’s earnings yield to assess the company?

The earnings yield is used to show the percentage of a company’s earnings per share. Investors typically use earnings yield to determine which assets are underpriced or overpriced relative to other variables, like sector, industry or bond yields. Simply put, the earnings yield of a company can be used to assess how expensive a company is in relation to the earnings that are generated. When valuing companies, the SIS Research Group does not utilize the inverse P/E ratio to calculate the earnings yield. Instead, we use an adjusted earning yield calculation to capture variation amongst companies (i.e. debt and tax rates).

The current earnings yield for Stagwell is 12.57%%, in comparison to 3.55% for the S&P 500 and 1.59% for the 10-year treasury bond. The median earnings yield for the Advertising industry is 9.51%.

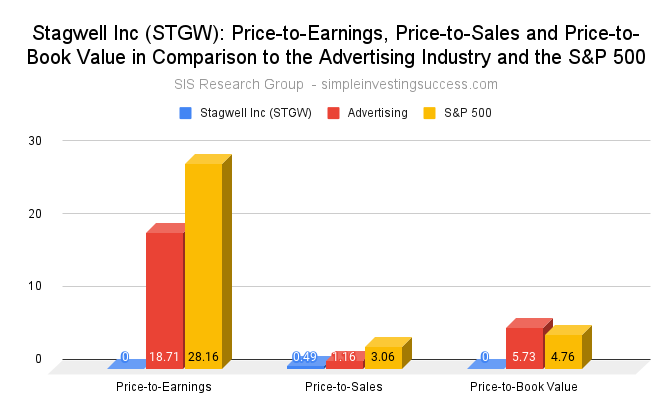

What does Stagwell’s Price-to-Earnings Ratio (P/E) tell investors about the company?

The price-to-earnings ratio (P/E) is a relatively popular metric used by investors and analysts for valuing a company’s stock. The P/E ratio can be used to show how a stock’s valuation compares to other companies and the total market. Investors use the P/E ratio to determine what the market is willing to pay today based on a company’s past or future earnings. A high P/E ratio could mean that a stock’s price is too high relative to earnings, which could be a signal that a stock is currently overvalued. In turn, a low P/E ratio could indicate that a company’s current stock price is low relative to earnings.

Stagwell does not currently have a reported P/E ratio. The P/E for the Advertising industry is 18.71 and the P/E for the S&P 500 is 28.16.

What is the current Price-to-Sales Ratio (P/S) for STGW stock?

The Price-to-Sales Ratio (P/S) looks at a company’s market cap and revenue to determine valuation. The P/S ratio is calculated by taking a company’s market cap and dividing by the total sales or revenue. The P/S ratio gives an idea of how much the market values every dollar of a company’s sales and can be effective in valuing unprofitable growth stocks or companies that are currently undergoing special situations or challenges. A lower the P/S ratio can be an indicator of good value.

Stagwell is currently trading at a P/S of 0.49. The P/S for the Advertising industry is 1.16 and the P/S for the S&P 500 is 3.06.

How does Stagwell’s Price-to-BookRatio (P/B) compare to the Advertising industry?

Price-to-book value (P/B) is the ratio of the market value of a company’s shares divided by its book value of equity (the value of it’s assets on the books). The book value is the difference between the book value of assets and liabilities. Typically, investors use the P/B ratio to assess if a stock is valued properly (a value of one means that the stock price is trading in line with the book value of the company). A company with a high P/B ratio could mean the stock price is overvalued as well as the converse.

Stagwell’s does not currently have a reported P/B. The P/B for the Advertising industry is 5.73 and the P/B for the S&P 500 is 4.76.

How attractive is Stagwell Return on Invested Capital (ROIC) to investors?

Investors use the return on invested capital (ROIC) to assess how efficient a company is at turning capital into profits. The ROIC is the amount of money a company makes on it’s investments that is above the average cost of debt and equity.

Investors can use the ROIC to provide context for metrics like the (P/E) ratio. For instance, when used in isolation a low P/E ratio could suggest a company is oversold but the decline could be because a company is no longer generating value for shareholders. Conversely, companies that consistently generate high rates of ROIC can plausibly trade at a premium compared to other stocks, even if their P/E ratios are high.

Stagwell’s ROIC is currently -25.92% in comparison to 5.20% for the Advertising industry and 8.60% for the S&P 500.

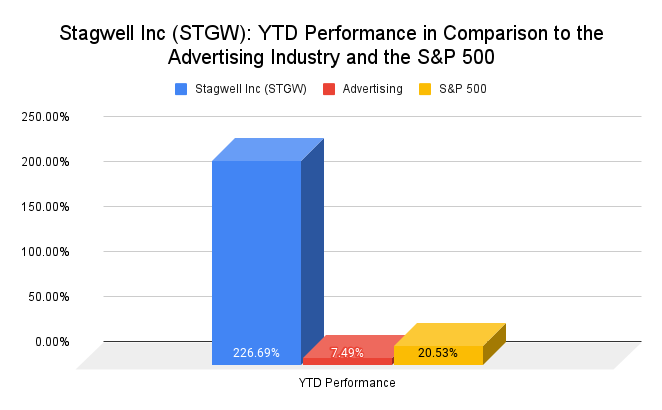

What is STGW stock YTD Performance in comparison to its industry and the total market?

The year-to-date (YTD) performance is the amount of profit/loss realized by a stock since the first trading day of the current calendar year.

The YTD performance for Stagwell is 226.69%. The Advertising industry has a YTD performance of 7.49% in comparison to the YTD S&P 500 performance of 20.53%.

Recent Financial Results (Q1 2021)

- Net revenue reported of $158.1M compared to $150.8M in previous years quarter (an increase of 4.8%.)

- Double-digit growth across nearly all non-COVID impacted segments totaling $21.6M

- COVID impacted segments (e.g., Digital – Content and Research – Technology) had declines of $14.4M

- Net income of $4.6M as compared to $12.5M YoY (decrease of 63.2%)

- Cash from operating activities of $5.8M as compared to $8M YoY (decrease of 27.5%)

- EBITDA $157.9M

Stock Price Target: $19.21

Company Overview

Stagwell provides marketing, advertising, and strategic consulting solutions in the United States, Canada, and internationally. The company offers global advertising and marketing, data analytics, direct marketing, and optimization services to it’s customers.

The company was formerly known as MDC Partners Inc. and changed its name to Stagwell Inc. in August 2021. Stagwell Inc. was founded in 1980 and is headquartered in New York, New York. The current CEO is Mark Penn.

Be sure to add Stagwell (STGW) to your Watch List and if you haven’t done so already, check in on the performance of our Current Portfolio. Keep it simple and always do your due diligence.

This material is provided for informational purposes only and is not financial advice. The information contained herein should not solely be used for the formation of an investment decision, whether you are a long term or short term investor.